The Best Fluffy Pancakes recipe you will fall in love with. Full of tips and tricks to help you make the best pancakes.

Leading a company requires a special skill set; unfortunately, not all CEOs have what it takes. While some excel, others plummet their businesses into failure with astonishing rapidity. Redditors unite to recount tales of CEOs leading companies to ruin through incredible financial missteps and bewildering decision-making. These stories of corporate collapse are both shocking and hard to believe.

#1: The Failings of a Construction Company

A thriving construction firm earning $100-$200 million annually imploded when the inexperienced son of the deceased owner took over. Within months, valuable employees departed, and equipment was repossessed, signaling a remarkable downfall.

Failing to uphold financial commitments caused the company to see an exodus of talent due to unpaid wages. Within six months, a once-flourishing business was stripped of its contracts and sold off cheaply, a testament to rapid mismanagement and decline.

#2: A Cautionary Tale of Mismanagement

A car dealership enthusiast turned nonprofit library wholesaler CEO, disastrously managed the company. He alienated staff with childish policies and clueless hires, leading to a mass exodus of experienced personnel and a dilapidated organizational structure.

His obstinate nature and refusal to adapt led to operational paralysis, depriving libraries of vital inventory. The final straw for many was burdening employees with extra duties sans compensation. Consequently, a company with a history spanning over 60 years collapsed shortly after his tenure began.

#3: Mall Staff Swap Gone Wrong

In an unusual district manager decision, an entire cell phone store team was swapped between malls, sparking dissent. Accustomed to our prime location and high sales, this move seemed illogical, especially as we were relocated to a less thriving mall.

The aftermath was swift and brutal: The top employee left in three days, and I followed suit after a week, taking my six years of experience with me. Soon after, the remaining staff, including the manager, resigned, leaving our once-thriving store in ruins.

#4: Returning to Foundations

U/ThisIsMyCouchAccount shares, “Ruin may be harsh, but the outcome was poor. A small firm aimed for growth and bigger clients, so they onboarded a CEO. However, his corporate approach didn’t match the company’s culture.”

“The company, known for valuing employees and transparency, clashed with the CEO’s corporate tactics. It led to his dismissal after 18 months, prompting the original owners to take charge again,” U/ThisIsMyCouchAccount concludes.

#5: Flexibility Fallout

The new male owner scrapped flexible contracts at a small, female-dominated company. This led to a staff exodus to a rival firm, causing a two-week shutdown. Flexibility’s absence proved detrimental.

Following the mass departure and company shutdown, the company’s reputation suffered. Fortunately, a former colleague recommended me elsewhere, resulting in a job offer with improved pay and conditions.

#6: From Triumph to Tragedy

After dedicating 35 years to his thriving business, my dad sold it upon retiring. Soon after, the new management’s poor treatment led to mass employee departures, turning a once-desirable workplace into a ghost town.

In just six months, the business faced a severe downturn, struggling to find work for employees during what used to be the busiest season. The once successful business had shut down by the one-year mark, showcasing a startling and rapid decline.

#7: From Generosity to Austerity

A national competitor distributed its profits generously: 50% to employees, 40% to managers, and the remainder among others, with some managers earning up to $400k yearly. However, upon the founder’s demise, his son ceased this profit-sharing scheme.

Post-profit-sharing cut, the company saw significant talent departure, as reflected in their declining Google ratings from 4.5 to below 4 stars, less crowded parking lots, and a drop in managerial motivation and earnings from potentially $400k to around $75k.

#8: Dealing with a Tyrannical Superior

In the 90s, despite leading a thriving sales department, a new challenge arrived. The big boss’s son, known for previous failures, was introduced to the company.

The newcomer turned his sights on me, employing bullying and belittlement. Advised to endure silently, this unwelcome change drastically altered my life’s path, leaving me yearning for karmic justice.

#9: Collapse of a Family Business

At my last position, the son took charge of a once-thriving business, leading to unprecedented profits and expansion amid the lockdown, culminating in the construction of a new factory.

However, overproduction during the pandemic led to the loss of key contracts. The company is grappling with an oversupply, cutting staff and overtime, and prompting skilled workers to leave. Rumors now swirl about its closure by January, marking the end of a 145-year legacy.

#10: The Cost of Leadership Ego

U/PapaHop69 argues that power-hungry leaders aim to leave a mark by changing efficient systems for personal legacy rather than appreciating staff efforts that generate annual record profits. They deny raises and compensate with token gestures.

Acknowledging the stark contrast between executives’ millions and employees’ struggle to afford necessities, U/PapaHop69 criticizes the oversight of beneficial schemes like profit-sharing bonuses, highlighting the absurdity of their absence in today’s workforce.

#11: A Lesson in Unexpected Outcomes

After joining a small manufacturer working on a promising product, we were acquired by a larger US food company. The initial warmth and promise of being essential soon turned sour when my contract ended abruptly the following day.

Contrary to assurances of necessity, my role was deemed ‘non-essential’, leading to termination. Shortly thereafter, about 60 jobs were lost, as the new owners underestimated the complexities of pharmaceutical regulations, causing a staggering $200 million loss.

#12: From Opulence to Obstacle

User u/therealpegarm narrates their experience at a luxury furniture e-commerce venture that saw three CEOs in four years. The trio had divergent views on technology’s importance, with the final leader regrettably nostalgic for simpler, tech-free times.

Their final CEO undermined product quality and vastly reduced the American workforce, outsourcing customer service to Colombia. This decision severely impacted delivery efficiency and product integrity, leading to a dramatic revenue fall from $6 million to less than $1 million monthly.

#13: A Cautionary Tale

U/littlemybb shares a forewarning ignored: Before the 2008 financial crash, a father advised his company’s CEO, a childhood friend, to cut back on extravagance. Displeased, the CEO terminated his employment.

Ignoring advice led to the CEO’s downfall. The CEO’s excessive spending and negligence, particularly in difficult times, resulted in the company’s loss and subsequent legal troubles, underlining the importance of heedful management and moderation.

#14: Silencing the Business Beat

U/technos shares a switch from a fastener company to a live music venue, citing excitement reasons. The move, masked as an operational strategy, intended to repurpose their warehouse into a music hub, supposedly benefiting the community.

The shift saw labor costs skyrocket and efficiency plummet in sales, as the company switched from same-day pickups to a 30-day minimum for large orders. This new direction led the company to bankruptcy in less than a year.

#15: The Risks of Putting All Your Eggs in One Basket

An employee watched as their workplace, initially designed for multiple clients, was refocused solely on one. They raised concerns about the risks of relying on a single client and foresaw potential job losses if that client ever left.

The inevitable happened after a year and a half; the sole client withdrew, leading to mass layoffs and the company’s closure. This outcome highlights the dangers of nepotism and the importance of professional expertise in key business positions.

#16: Downfall Tale

A local greenhouse/orchard with a 105-year legacy faced ruin when its new owner, after inheriting it, gave managerial control to a partner, leading to mass staff resignations.

Subsequent legal troubles, including multiple arrests, culminated in the business’s dismantling and sale, marking a rapid decline from a century-long family legacy.

#17: The Downfall of Compensation

As a result, only power-hungry, responsibility-shirking individuals remain, steering our company towards closure in January after two years.

#18: The Tale of a Local Jersey Enterprise

A hometown jersey business thrived for over two decades until 2016, when new ownership shifted production to the Dominican Republic.

By 2022, the sudden relocation under new management left the local workforce jobless, despite previous assurances of job security.

#19: Podcasting Over Business Growth

At a start-up, the CEO emailed the sales head about expanding the team during her maternity leave. Six months later, her input was finally sought in financial troubles, highlighting management missteps amidst the company’s growth challenges.

The company faced cutbacks, laying off many in engineering, HR, and marketing, yet spared the sales department. For six months, the CEO, prioritizing podcasting and building a LinkedIn presence, neglected to consult the sales head on crucial decisions.

#20: Farfetch’s Collapse

Farfetch once dazzled luxury fashion fans and investors alike. It was valued in the billions and seen as the digital gateway to high-end style. But beneath the glossy veneer lay chaos. Founder José Neves, once hailed as a visionary, was accused of mismanagement so severe that internal teams called it sabotage.

Allegations of poor governance, inflated forecasts, and reckless strategy emerged. The company’s value plunged by 99%, and Coupang picked up the scraps. For many, it was less a business stumble than a designer-clad freefall—a cautionary tale of ambition unmoored by oversight.

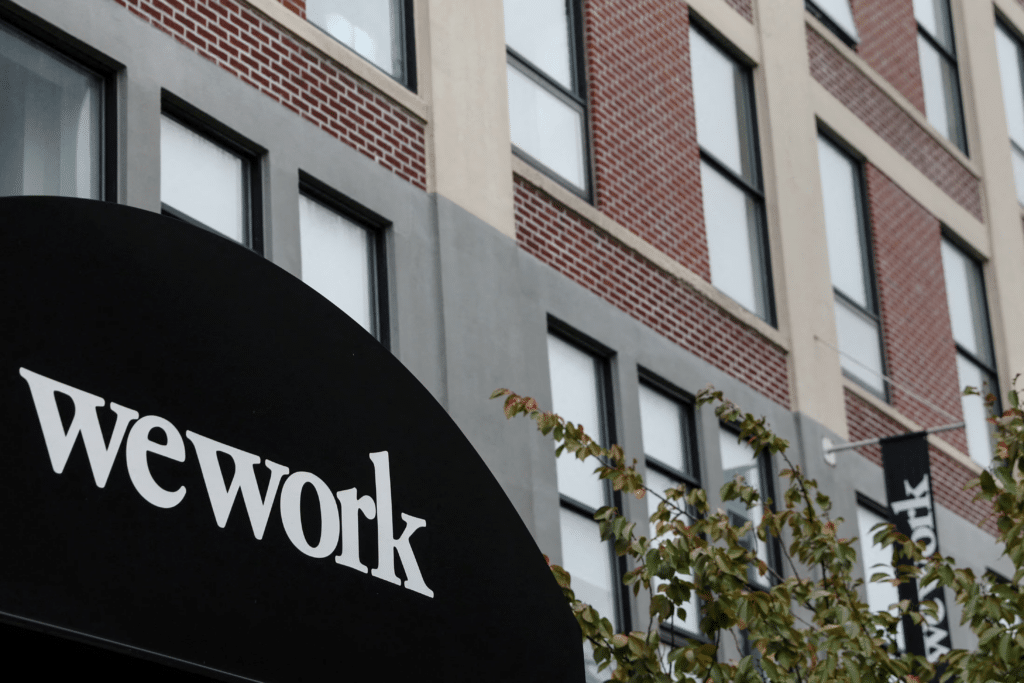

#21: A Shared Working Space Initiative Gone Wrong

Imagine a world where beanbags, beer taps, and community yoga equate to billion-dollar valuations. That was Adam Neumann’s WeWork, an empire built on the illusion of infinite scale. But as IPO dreams crumbled and investors sobered up, the smoke cleared to reveal no profits—just ping pong tables and unpaid bills.

Neumann’s eccentric leadership, jet-set lifestyle, and delusions of grandeur triggered a stunning collapse. The company, once worth $47 billion, was barely worth a fraction. Neumann walked away a billionaire, while employees clung to worthless stock options. WeWork’s downfall wasn’t just bad business—it was theatrical hubris.

#22: The Bankruptcy of a Giant

Carillion was the UK’s construction behemoth—trusted with hospitals, schools, and infrastructure. But behind the scaffolding, its balance sheets were crumbling. Creative accounting masked growing debt while directors pocketed bonuses.

Whispers of trouble became screams when suppliers went unpaid and pensions were raided to stay afloat. The collapse was thunderous: 43,000 jobs were at risk, 30,000 suppliers were unpaid, and public projects stalled. It wasn’t just a company imploding; it was a systemic failure.

#23: A Fintech Disaster

In a plot fit for a thriller, German fintech darling Wirecard duped investors, regulators, and auditors with fictional billions. CEO Markus Braun played the role of a digital visionary, while COO Jan Marsalek vanished like a Bond villain once the fraud emerged. The numbers never added up—because they didn’t exist.

A staggering €1.9 billion was missing, and the company collapsed within days. It was a national embarrassment and a global lesson in how even the most “tech-savvy” firms can be pure fiction. Wirecard wasn’t disrupted by competition—it self-destructed on a fantasy.

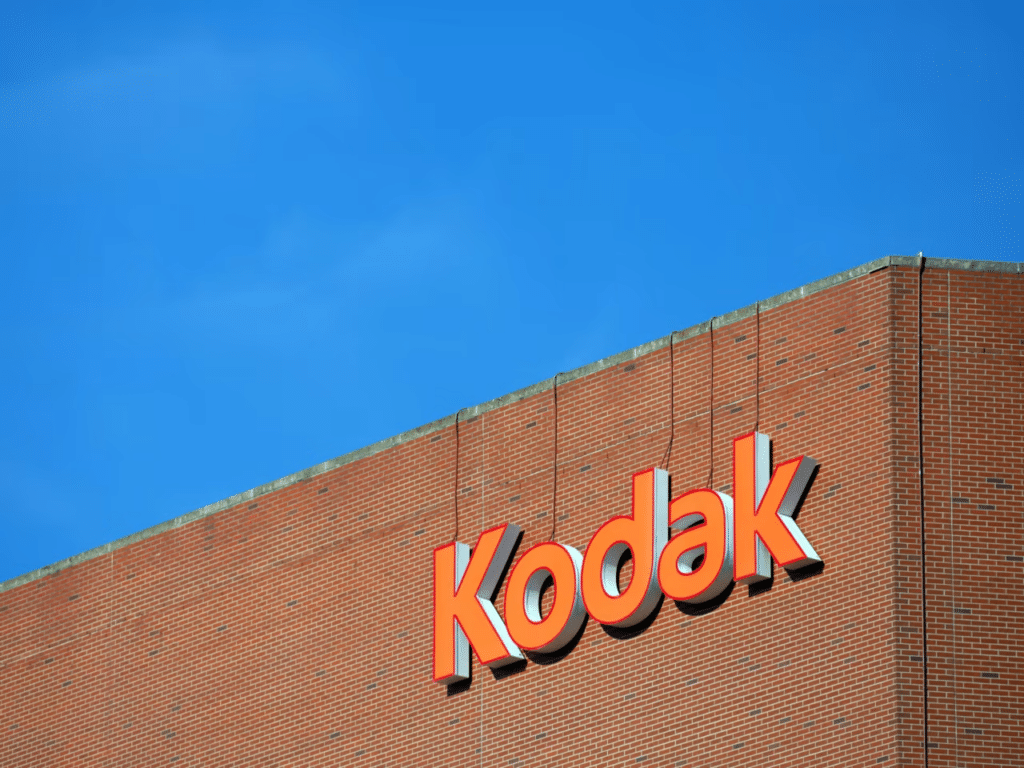

#24: Kodak’s Missed Digital Opportunity

In a delicious irony, Kodak invented the digital camera and then buried it. The fear? It would cannibalize their beloved film business. Instead of leading the future, Kodak clung to the past, pouring resources into paper prints as smartphones and DSLRs devoured the market.

By the time leadership realized the error, rivals had sprinted ahead. Bankruptcy followed. What’s tragic isn’t just Kodak’s fall, but the deliberate choice to ignore the innovation they birthed. Kodak didn’t fail due to ignorance—they failed from nostalgia. The lesson? Disruption doesn’t wait for permission, even from pioneers.

#25: Blockbuster’s Decline

There was a time when Friday nights meant a trip to Blockbuster—blue carpeted aisles, fluorescent lights, and the thrill of a “New Release” still on the shelf. But as the world shifted, Blockbuster didn’t. They laughed off Netflix’s mail-order model, dismissed streaming as a fad, and clung to late fees like a lifeline.

Their downfall wasn’t a single event—it was a long, awkward pause, like a scratched DVD that never resumed. In 2010, bankruptcy was inevitable. The irony? Netflix offered to partner. Blockbuster said no. Sometimes, the future knocks politely—before slamming the door behind you.

#26: The Collapse of Lehman Brothers Inc.

Lehman Brothers wasn’t just a bank—it was a titan. And like many titans before it, it fell hard. Fueled by the housing bubble and risky derivatives, Lehman’s gamble on subprime mortgages became a financial Molotov cocktail. As cracks formed, the firm doubled down, refusing to admit error.

In September 2008, the bubble burst, triggering the largest bankruptcy in U.S. history. Markets worldwide spiraled, and millions lost jobs, homes, and savings. Lehman’s name became synonymous with economic catastrophe. Their mistake? Thinking too big to fail meant being immune to consequences. It was a crash heard around the globe.

#27: The IT Scandal That Rocked India

Satyam Computers was India’s IT crown jewel for years—until it shattered. Founder Ramalinga Raju confessed to fabricating over $1 billion in assets. The revelation stunned the tech world for its scale and brazenness. Fake invoices, inflated staff numbers, and complicit auditors kept the illusion alive.

When the truth emerged, it was brutal. Satyam went from blue-chip to blacklisted overnight. The scandal rocked India’s corporate governance, prompting reforms and global scrutiny. Raju’s crime? Building a digital empire out of fiction. His confession began clearly: “It was like riding a tiger, not knowing how to get off.”